Fixed Term Deposit

Knowing what you get from the beginning

Make your money grow in a short time! The FIXED TERM DEPOSIT is your easy, transparent and quick way to accelerate your savings.

Fixed Term Deposit Definition

- Understanding Fixed Term. A common example of a fixed-term investment is a term deposit in which the investor deposits his or her funds with a financial institution for a specified period of time.

- A CD (certificate of deposit) is a type of deposit account that’s payable at the end of a specified amount of time (referred to as the term). CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts, depending on the market. These accounts typically provide security for longer-term savings and no monthly fees, but at the cost of access and liquidity of the funds.

Bank Of America Fixed Deposit Interest Rates as on 03 Mar 2021. Latest Update as on 03 Mar 2021, Bank Of America Fixed Deposits 2021, Bank FD News Mar 2021. It just allows you to deposit money into your Fixed Term Deposit and withdraw it at maturity. Is the interest rate fixed for the entire length of my term. Yes, the interest rate is fixed for the whole term of your Fixed Term Deposit. Any subsequent changes in the interest rate will only affect new Fixed Term Deposits. Can I access my money in. For Upfront Interest on fixed deposit: Interest earned on your fixed deposit/high yield, will be paid to your current or savings account with the Bank the next day after applying. Rollover, Top-up, and Early Liquidation options are not available.

If you know what you have and what need, just decide by yourself how long you wish to save or how much profit you wish to generate. Maturity reaches from 3 months to 3 years. You can open your FIXED TERM DEPOSIT account in local or foreign currency and track your savings balance online.

Knowing what you get from the beginning

Fixed Term Deposit Rates Australia

Make your money grow in a short time! The FIXED TERM DEPOSIT is your easy, transparent and quick way to accelerate your savings.

If you know what you have and what need, just decide by yourself how long you wish to save or how much profit you wish to generate. Maturity reaches from 3 months to 3 years. You can open your FIXED TERM DEPOSIT account in local or foreign currency and track your savings balance online.

FEATURES AND REQUIREMENTS:

| Maturity: | 3 months, 6 months, 1 year, 2 years or 3 years |

| Interest rate: | Contact us for rates |

| Minimum opening balance: | USD1,000 |

| Depositor age requirement: | 18 years or above |

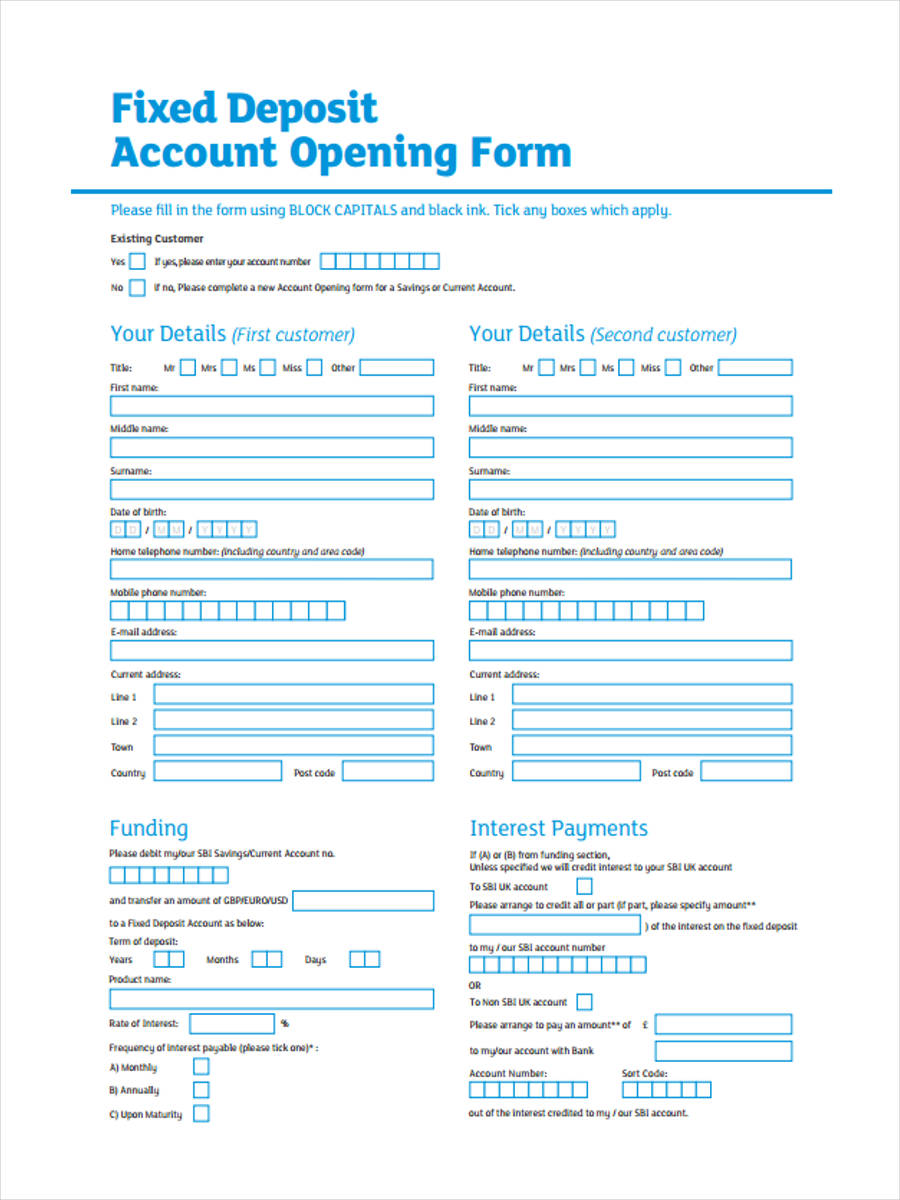

To open a FIXED TERM DEPOSIT account, an identification document of the account holder is required.

For further information, contact one of BRED’s relationship managers.

Or download our Terms & Conditions

Contact us about this product or to set up an appointment