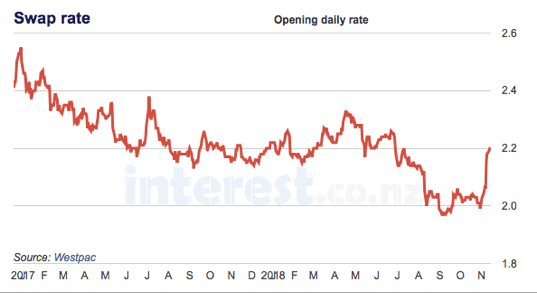

Westpac Term Deposit Rates Nz

Use our interest rate tables to find the best term deposit rates online from most NZ lenders. You are able to quickly compare interest rates, lenders, products and terms. Westpac NZ 1 Year Term Deposit The interest rate for this deposit is for a 1 year / 12 month term and applies to amounts deposited $10,000 to $249,999. It is paid at maturity, however please note their are interest monthly options available. The rate of 3.40% is 0.32% higher than the average 3.08%.

Features and benefits

- No monthly account service fee or establishment fee

- High fixed interest rate on balances of $1,000 and above1

- A range of fixed investment terms available to suit your needs

- Interest paid 6 monthly and at maturity2.

Fees

Refer to the Fiji Customer Service Fees Booklet for details (PDF 98KB)

Here’s what to do.

To open a Westpac personal bank account, you’ll need to provide us with a signed and completed personal account opening form, along with some current identification documents.

We need to verify the following:

Westpac Term Deposit Rates Nz Interest Rate

- Full name

- Date of birth

- Residential address

- Occupation

- Photo identification and signature

- Citizenship

- Income source documentation

To ensure these 7 points above are verified, we need at least two primary ID documents or one primary plus two secondary ID documents. All documents must be original and current unless specified. If additional documents are required, we’ll let you know.

Download the Opening a Personal Bank Account Brochure (PDF 129KB) for a list of accepted Identification and Additional Identification required for non-residents. Visit your branch or call 132032 for more information.

Need help?

Simply speak to a Banking Representative by calling 132 032.

Things you should know

Conditions apply. Offer excludes corporate, institutional and government customers. If you are on a special rate and your Term Deposit rolls over automatically, the Term Deposit may be automatically re-invested at a lower rate than the current interest rate.

1. Interest rate adjustment may apply if funds are withdrawn before maturity.

Term Deposit Interest Rates Nz

2. Once your fixed term ends, you can withdraw your funds via bank cheque, cash or direct credit into another bank account.